Financial Services

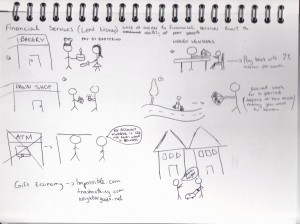

The majority of poor people have no access to financial services such as savings, transaction banking, credit and insurance. This has as a result poor people to be trapped in a cycle of poverty. In the UK and US over 10% of the population is “unbanked”. By not be able to open a bank account they cannot get a loan from the bank or apply for a credit card and this has as a result poor people to not have opportunities for business activities or buy something that will help them to lift themselves out of poverty etc.

The challenge for my system is to find ways where people can will be able to borrow or get money from somewhere without the need of having a bank account.

Below there are a few sketches of ideas that can help “unbanked” people:

Cyber Crime.

As the years passes cyber-crime grows and evolves. Even if you have an antivirus system, you cannot be sure that your personal details will not be stolen. Hackers are inventing new banking Trojans or key loggers to access individual bank accounts. So how we can be sure that online shopping or entering internet banking is safe.

Below you can find a number of roughly- rough sketches presenting some my ideas of how to how we can avoid cyber-crime:

References:

http://www.driversofchange.com/tools/doc/convergence/cyber-crime/

http://www.driversofchange.com/tools/doc/poverty/financial-services/